- stative

- Posts

- #14: Stablecoins vs SWIFT: Is the Future of Money Moving Off Legacy Rails?

#14: Stablecoins vs SWIFT: Is the Future of Money Moving Off Legacy Rails?

As global payments accelerate and legacy rails show their limits, stablecoins are emerging as a real-time alternative to SWIFT’s decades-old infrastructure.

Cross-border payments and global transfers are so commonplace today that we hardly notice the complex infrastructure behind them. But the system that makes this possible — the SWIFT network — is showing its age in an increasingly digital world.

A new contender is emerging: stablecoins — programmable digital cash that can move value across borders instantly. This article breaks down what SWIFT is, how stablecoins differ, where the transition is already happening, and what this might mean for the future of money.

What Is SWIFT?

SWIFT (the Society for Worldwide Interbank Financial Telecommunication) is a messaging network that banks use to communicate payment instructions securely with each other. It doesn’t actually move money; it transmits instructions that correspondent banks reconcile and settle through existing banking systems such as Fedwire or T2.

Key features of SWIFT:

A universal messaging language connecting more than 11,000 banks worldwide

Global reach without bespoke bilateral connections

Embedded tracking, auditability, and standardized formats

Despite its reliability, SWIFT still relies on intermediaries, local banking infrastructure, and batch settlement windows that introduce delays, costs, and operational complexity — especially across time zones and jurisdictions.

How Stablecoins Can Replace SWIFT

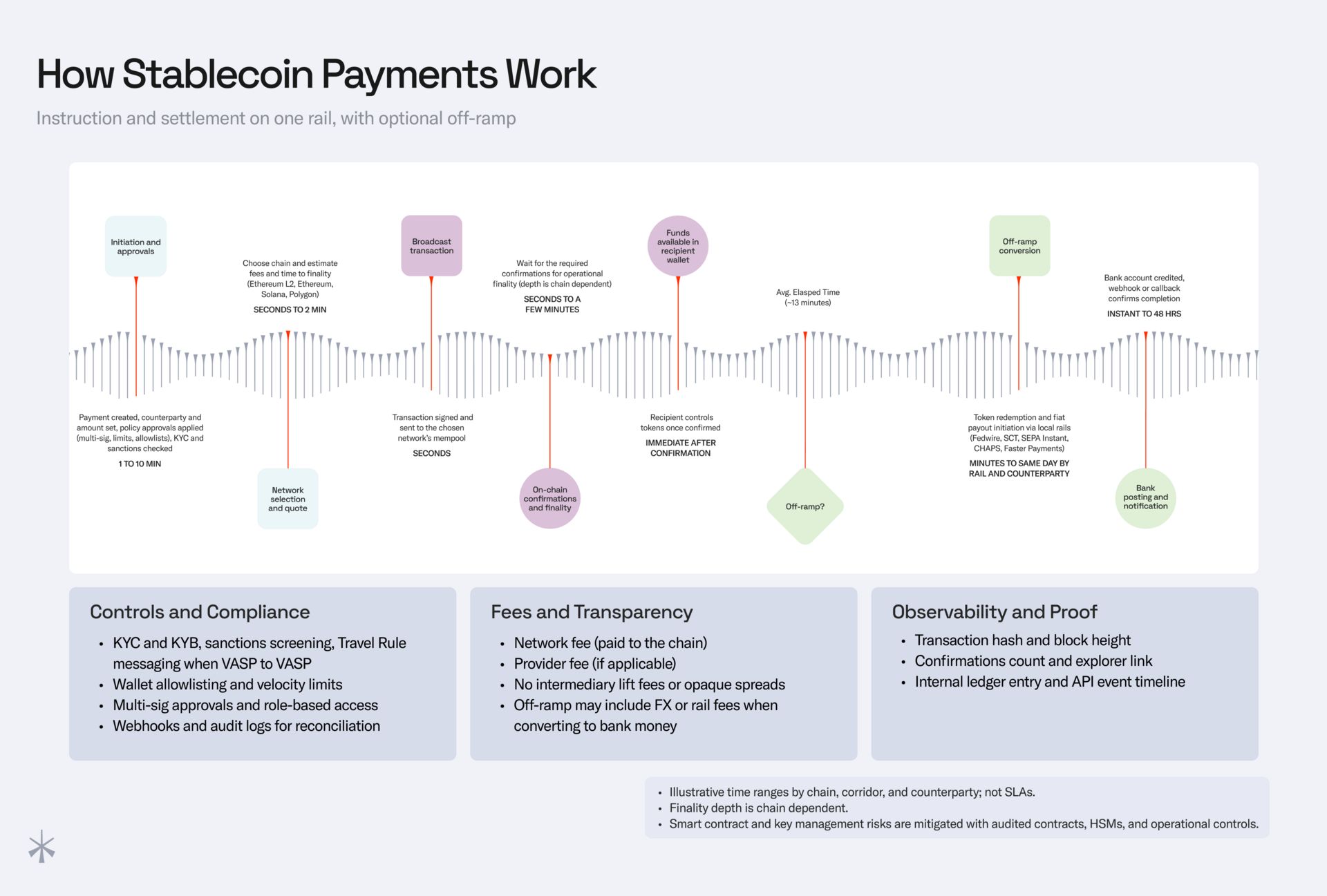

Stablecoins are digital tokens pegged 1:1 to fiat currencies like the U.S. dollar or euro. Instead of separating messaging and settlement, stablecoin transactions combine both into a single on-chain action.

Funds sent via blockchain become available to the recipient as soon as the transaction confirms — typically within seconds or minutes. This removes the need for correspondent banking reconciliation, reduces settlement risk, and dramatically accelerates cross-border transfers.

In short, stablecoins collapse the traditional payment stack into one real-time settlement layer.

Real-World Developments and Early Adoption

Stablecoins are already moving into territory historically dominated by SWIFT:

Daily stablecoin transaction activity has reached tens of billions of dollars, approaching the scale of major global payment networks.

Regulatory clarity is improving, with several jurisdictions formally recognizing stablecoins as payment instruments.

Payment companies and cross-border networks are integrating stablecoins to accelerate settlement and reduce costs.

Fintech firms are launching stablecoin-based transfer products specifically designed to compete with legacy correspondent banking flows.

These developments signal real economic demand for faster, cheaper, and always-on global payment rails.

Stablecoins vs SWIFT — Key Differences

Feature | SWIFT | Stablecoins |

|---|---|---|

Settlement model | Messaging only; funds settle via correspondent banks | Atomic on-chain settlement |

Speed | Hours to days | Seconds to minutes |

Availability | Limited by banking hours and time zones | 24/7/365 |

Cost | Multiple intermediaries, fees, and FX spreads | Low network transaction fees |

Transparency | Traceable through banking systems | Fully visible on-chain |

Access | Requires bank participation | Wallet-based global access |

Programmability | Minimal | Native smart-contract automation |

SWIFT delivers trust, governance, and institutional reach.

Stablecoins deliver speed, efficiency, and programmability.

I was inspired to do this post by this article from noah and found these two graphics especially interesting, which is why I wanted to share them here as well:

Where Stablecoins Make the Most Sense

Stablecoins are not yet a universal replacement for SWIFT, but they clearly outperform legacy rails in several areas:

Frequent, low-value cross-border transfers

Remittances and payroll payments

Supplier settlements and treasury movements

Real-time digital commerce and programmable payments

Large, high-value institutional transfers may continue relying on traditional settlement systems for the foreseeable future, but the competitive pressure is increasing.

Outlook and Food for Thought

The transition from legacy payment rails to blockchain settlement will likely be gradual rather than sudden.

Incumbent infrastructure is adapting, regulation is evolving, and hybrid payment models are emerging where traditional systems and stablecoins coexist. Over time, however, the structural advantages of instant, borderless, programmable settlement are difficult to ignore.

If real-time global value transfer becomes technically trivial, the question shifts from whether stablecoins can replace parts of SWIFT to how much of the financial system ultimately moves onto programmable rails.

And once money can move as easily as information, the deeper question emerges:

What new forms of finance become possible when settlement is no longer the bottleneck?

Thanks for reading in 🤍

// Kai